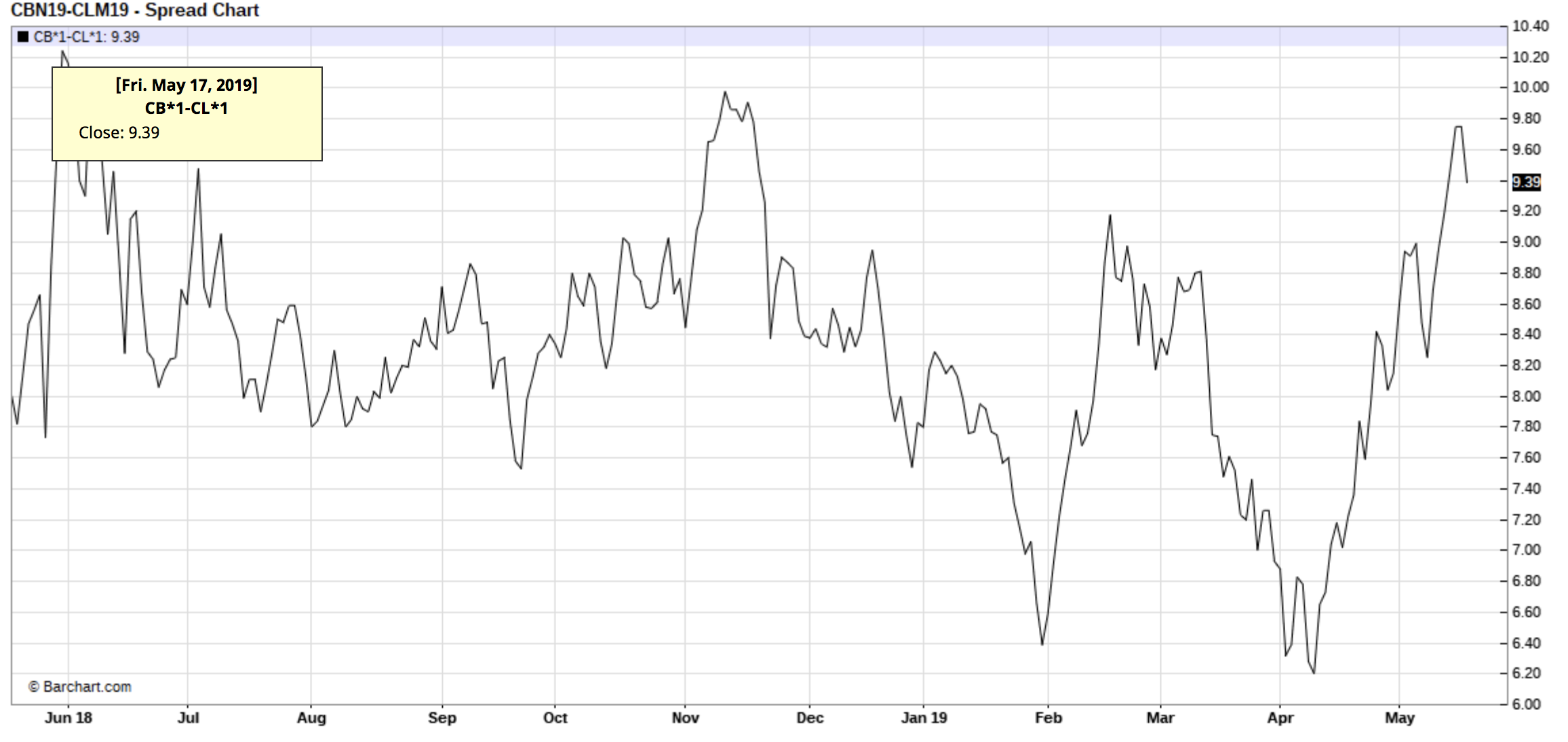

321 Crack Spread Today

Crack spread refers to the overall pricing difference between a barrel of crude oil and the petroleum products refined from it. It is an industry-specific type of gross processing margin. The “crack” being referred to is an industry term for breaking apart crude oil into the component products, including gases like propane, heating fuel, gasoline, light distillates like jet fuel, intermediate distillates like diesel fuel and heavy distillates like grease. The price of a barrel of crude oil and the various prices of the products refined from it are not always in perfect synchronization. Depending on the time of year, the weather, global supplies and many other factors, the supply and demand for particular distillates results in pricing changes that can impact the profit margins on a barrel of crude oil for the refiner. To mitigate pricing risks, refiners use futures to hedge the crack spread. Futures and options traders can also use the crack spread to hedge other investments or speculate on potential price changes in oil and refined petroleum products.

Breaking Down Crack Spread

Crack Spreads. The crack spread represents the theoretical refining margin. If a crack spread is a positive number then the price of the refined products is higher than that of crude oil, the raw material, and the spread is profitable. If the spread is a negative number, the products are priced at less than the cost of crude and are not profitable. Crack spread refers to the overall pricing difference between a barrel of crude oil and the petroleum products refined from it. It is an industry-specific type of gross processing margin. Find information for RBOB Gasoline Crack Spread Futures Quotes provided by CME Group. All Products Home Active trader. Find opportunities, daily market data and insights for the active individual trader. Find a broker. Search our directory for a broker that fits your needs. May 02, 2017 What Crack Spreads Say About Oil Prices By Brian Noble. The crack spread is a specific spread trade involving simultaneously buying and selling. . Related Discussion Forum Messages As a ValueForum member, this section would contain CRACK321 message board posts where the ticker symbol CRACK321 has been mentioned by ValueForum members in posts.Learn more about guest access, and benefits of membership- we hope you will consider joining ValueForum or trying out our service with a 24 hour trial pass.

The traditional crack spread plays used to hedge against these risks involves the refiner purchasing oil futures and offsetting the position by selling gasoline, heating oil or other distillate futures that they will be producing from those barrels. Refiners can use this hedge to lock in profit. Essentially, refiners want a strong positive spread between the price of barrel of oil and the price of the refined products, meaning a barrel of oil is significantly cheaper than the refined products. To find out if there is a positive crack spread, you take the price of a barrel of crude oil - in this case, WTI at $51.02/barrel, for example - and compare it to your chosen refined product - let's say RBOB gasoline futures at $1.5860 per gallon. There are 42 gallons per barrel, so a refiner gets $66.61 for every barrel of gasoline for a crack spread of $15.59 which can be locked in with future contracts. This is the most common crack spread play, and it is called the 1:1 crack spread.

Of course, it is a bit of an oversimplification of the refining process as one barrel of oil doesn't make exactly one barrel of gasoline and, again, different product mixes are depending on the refinery. So there are other crack spread plays where you buy three oil futures and then match the distillates mix more closely as two barrels worth of gasoline contracts and one worth of heating oil for example. These are known as 3:2:1 crack spreads and even 5:3:2 crack spreads, and they can also be used as a form of hedging for investment in refiners themselves. For most traders, however, the 1:1 crack spread captures the basic market dynamic they are attempting to trade on.

Trading the Crack Spread

Generally, you are either buying or selling the crack spread. If you are buying it, you expect that the crack spread will strengthen, meaning the refining margins are growing because crude oil prices are falling and/or demand the refined products are growing. Selling the crack spread means you expect that the demand for refined products is weakening or the spread itself is tightening due to changes in oil pricing, so you sell the refined product futures and buy crude futures.

Lets go to prison stream. 'Let's Go to Prison' is currently available to rent, purchase, or stream via subscription on VUDU, YouTube, Amazon.com, iTunes Store, and XFINITY. Stream and Watch Online. Watch Let's Go to Prison 4K FOR FREE Let's Go to Prison John Lyshitski is a car stealing slacker, with a weed problem, and has been in Illinois' Rossmore State Penitentiary so many times, he knows its entire population of both staff and cons by their first names. Watch Let's Go to Prison (2006) Full Movie Online Free, Download Free Movies Torrent 720P 1080P John Lyshitski is a car stealing slacker, with a weed problem, and has been in Illinois'. Start your free trial to watch Let's Go to Prison and other popular TV shows and movies including new releases, classics, Hulu Originals, and more. It’s all on Hulu.

Reading the Crack Spread as a Market Signal

Gasoline Crack Spread Today

Even if you aren't looking to trade the crack spread itself, it can act as a useful market signal on potential price moves in both the oil and refined product market. If the crack spread widens significantly, meaning the price of refined products is outpacing the price of oil, many investors see that as a sign that crude oil will eventually rise in price to tighten the spread back up to historical norms. Similarly, if the spread is too tight, investors see that as a sign that refiners will slow production to tighten supply to a level where the demand will restore their margins. This, of course, has a dampening effect on the price of crude oil. So, whether you intend to trade it or not, the crack spread is worth keeping an eye on as a market signal.